The future of electronic wallets and payments: Changing how we pay

June 14, 2023 | Read Time : 3 mins

Table of Contents

Introduction

In an increasingly digital world, electronic wallets and payments have emerged as key drivers of financial innovation. With the advent of smartphones and technological advancements, electronic wallets have transformed how we transact, providing convenience, security, and efficiency. This blog explores the future of electronic wallets and payments, examining the trends and developments that will shape the landscape of financial transactions. From mobile payments to blockchain integration and the rise of digital currencies, the future holds exciting possibilities for the evolution of electronic wallets.

Mobile wallets: The era of digital payments

Mobile wallets have revolutionized how we make payments, offering a convenient and secure alternative to traditional methods. This section delves into the growth of mobile wallets, including:

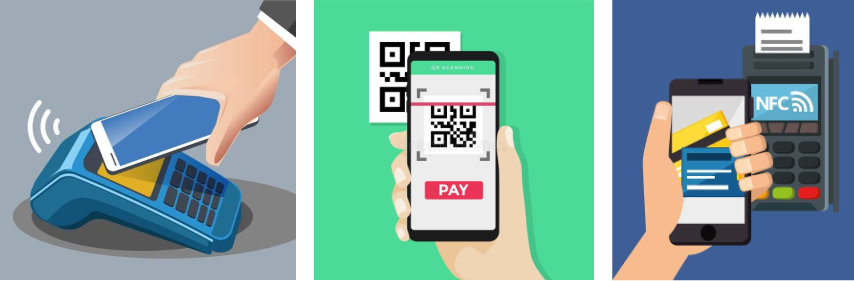

- The rise of mobile payment apps, such as Apple Pay, Google Pay, and Samsung Pay, has enabled users to store their payment information securely on their smartphones.

- These apps facilitate seamless transactions, eliminating the need for physical cards or cash.

- Near Field Communication (NFC) technology has played a vital role in adopting mobile wallets, enabling contactless payments by simply tapping smartphones or cards on payment terminals.

- NFC technology has revolutionized the retail experience, making transactions faster and more convenient.

The role of blockchain in electronic wallets

Blockchain technology holds immense potential for the future of electronic wallets. This section explores the integration of blockchain with electronic wallets, including:

- Blockchain-based electronic wallets enable users to have complete control over their digital assets without the need for intermediaries.

- These wallets offer enhanced security, privacy, and transparency for users.

- Smart contracts, powered by blockchain technology, can automate and enforce agreements between parties, opening up new possibilities for electronic wallets.

- Programmable money allows for conditional transactions and enhances the efficiency and security of financial interactions.

Cross-Border payments and global connectivity

Electronic wallets have the potential to streamline cross-border payments and enhance global connectivity. This section explores the future of cross-border payments, including:

- Electronic wallets enable individuals and businesses to send and receive money across borders more efficiently and cost-effectively.

- Integrating electronic wallets with remittance services reduces fees and provides faster settlement times.

- Cryptocurrencies, such as Bitcoin and Ethereum, have gained traction as alternative forms of payment, enabling borderless transactions and reducing reliance on traditional fiat currencies.

- The future may see increased acceptance of digital assets within electronic wallets, bridging the gap between traditional and digital economies.

Biometric security and user authentication

Ensuring the security of electronic wallets is crucial for widespread adoption. This section explores the advancements in biometric security and user authentication, including:

- Biometric authentication methods, such as fingerprint scanning and facial recognition, provide an extra layer of security for electronic wallets.

- These technologies ensure that only authorized users can access and authorize transactions, mitigating the risk of fraud and unauthorized access.

- Electronic wallets may adopt multi-factor authentication to enhance security further, combining biometrics with additional verification methods, such as PINs or tokens.

- Multi-factor authentication provides an added level of protection against unauthorized access.

Artificial intelligence and personalised experiences

Artificial Intelligence (AI) is poised to revolutionize electronic wallets by delivering personalized experiences and optimizing financial management. This section covers the following:

- AI algorithms can analyze spending patterns, provide personalized financial insights, and offer recommendations to users within their electronic wallets.

- These tools empower users to make informed financial decisions and improve their well-being.

- Virtual assistants powered by AI can assist users in managing their electronic wallets, providing real-time support and guidance.

- Virtual assistants can help users with tasks such as making payments, tracking expenses, and managing subscriptions.

IoT integration and connected commerce

The Internet of Things (IoT) presents opportunities for electronic wallets to become integral to connected devices and facilitate seamless transactions. This section explores:

- IoT integration allows electronic wallets to be linked with various connected devices, such as wearables, smart home devices, and vehicles.

- Users can make payments directly from these devices, transforming them into payment tools.

- Electronic wallets can be integrated with smart home systems, enabling users to pay for utilities, groceries, and other services seamlessly.

- The future may see further integration, where smart devices automatically reorder products and initiate electronic wallet payments.

Regulatory landscape and security measures

As electronic wallets evolve, regulatory frameworks and security measures must keep pace. This section highlights the following:

- Governments and regulatory bodies must establish clear guidelines to ensure consumer protection, data privacy, and security in electronic wallets.

- Collaboration between regulators and industry stakeholders is crucial to balance innovation and regulatory compliance.

- Continuous advancements in encryption technologies, tokenization, and fraud detection algorithms are essential to safeguard electronic wallets.

- Electronic wallet providers must prioritize user education and awareness to mitigate the risks associated with cyber threats and phishing attempts.

The future of electronic wallets and payments holds immense potential to transform how we transact and manage our finances. Mobile wallets, blockchain integration, cross-border payments, and biometric security measures are reshaping the financial landscape. As AI, IoT, and personalized experiences converge, electronic wallets will become integral to our connected world. However, ensuring regulatory compliance and robust security measures are paramount to building trust and facilitating widespread adoption. As we embark on this transformative journey, electronic wallets are poised to empower individuals and businesses, driving financial inclusion, convenience, and efficiency.