Navigating Fintech: Overcoming UX Hurdles and Disrupting Traditional Banking

August 10, 2023 | Read Time : 3 mins

Table of Contents

The financial technology (fintech) sector has witnessed exponential growth, transforming how people manage their finances. As the fintech industry thrives, providing seamless and user-friendly experiences is crucial for gaining a competitive edge.

However, achieving a stellar user experience (UX) in fintech is no easy feat. In this blog, we will explore the key hurdles that UX designers encounter in the fintech domain and explore possible solutions to overcome them.

Key Hurdles in Fintech Faced by UX Designers

a. Complex Regulatory Landscape: One of the most significant challenges in fintech UX design arises from the complex regulatory environment in the financial sector. Fintech companies must adhere to stringent rules and guidelines imposed by various regulatory bodies. These regulations are in place to ensure data security, prevent fraud, and safeguard customer interests. While these regulations are essential, they can often create friction in the user experience. Lengthy identity verification processes, mandatory data collection, and extensive legal jargon can overwhelm users and deter them from using fintech services.

To overcome this hurdle, UX designers must work closely with legal and compliance teams to balance adhering to regulations and creating a seamless user experience. Employing innovative technologies like biometric authentication and secure document verification can streamline onboarding while maintaining security standards.

b. Building Trust and Credibility: Establishing trust is paramount in the fintech industry, as users entrust their financial information to these platforms. Many users still prefer traditional financial institutions due to their longstanding reputation and credibility. On the other hand, Fintech startups often face challenges in convincing users to switch to their platforms.

UX designers must focus on instilling user confidence by designing interfaces that communicate security, transparency, and reliability. Incorporating trust signals such as SSL certificates, clear and concise privacy policies, and customer testimonials can help build credibility and alleviate user concerns.

c. Data Privacy and Security: Data breaches and privacy concerns are constant issues in the digital world, and fintech companies are high-value targets for hackers. Balancing the need for robust security measures with a smooth user experience is a delicate task. Lengthy authentication processes and frequent security prompts can frustrate users, impacting retention rates.

UX designers must prioritize data protection without compromising on user experience. Implementing advanced encryption protocols, two-factor authentication, and continuous monitoring can enhance security while ensuring the user experience remains seamless.

d. Financial Complexity and Jargon: The world of finance is filled with complex terminology and intricate processes. Presenting financial information in a user-friendly manner can be a daunting task for UX designers. Users who struggle to understand the products or services offered are likelier to abandon the platform.

To overcome this hurdle, designers should adopt a user-centric approach by simplifying language and providing contextual explanations. Interactive tools, such as calculators and personalized financial dashboards, can empower users to make informed decisions and easily navigate the platform.

e. Cross-Platform Consistency: In the fintech industry, users interact with services across various devices, including smartphones, tablets, and desktops. Maintaining consistency in the user experience across different platforms is crucial to avoid confusion and frustration.

UX designers must ensure a responsive design that adapts seamlessly to different screen sizes and resolutions. Consistent placement of navigation elements, buttons, and content helps users feel at home, regardless of their device.

f. Balancing Automation and Human Interaction: Automation is a key component of fintech platforms, enabling quick and efficient financial transactions. However, a fine line exists between automation and losing the human touch in interactions. Some users may still prefer human assistance for complex financial matters or during times of uncertainty.

To strike the right balance, UX designers should offer clear pathways for human support while ensuring that the automated processes are efficient and error-free. Incorporating chatbots, AI-powered customer support, and intuitive self-help resources can enhance user satisfaction.

How Fintech is Disrupting Traditional Banks

The rise of fintech has brought about a seismic shift in the financial services industry, posing significant disruptions to traditional banking models. Fintech startups are leveraging innovative technologies and user-centric approaches to provide tailored financial solutions that challenge the dominance of established banking institutions. Let’s explore some key ways in which fintech is disrupting traditional banks:

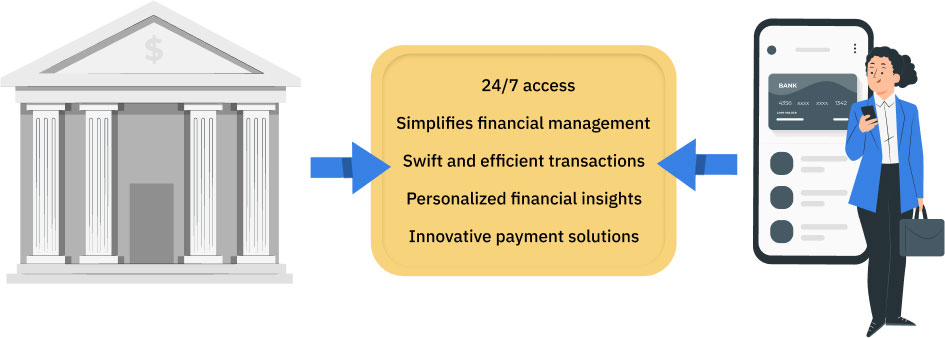

a. Seamless User Experience: Fintech companies strongly emphasise user experience, designing platforms and interfaces that are intuitive, user-friendly, and accessible 24/7. On the other hand, traditional banks have historically been burdened with complex processes, paperwork, and limited branch hours, leading to customer frustration.

Fintech platforms offer a seamless digital onboarding process, eliminating the need for physical visits to brick-and-mortar branches. This convenience appeals to tech-savvy customers who seek quick and hassle-free solutions. As fintech companies continue to refine their user experiences, traditional banks are under pressure to adapt and improve their digital offerings to stay relevant.

b. Personalisation and Data-Driven Insights : Fintech startups have a unique advantage in leveraging data analytics and artificial intelligence to understand customer behaviour and preferences. By analysing user data, fintech platforms can offer personalised financial recommendations, investment strategies, and budgeting tips.

Traditional banks, although possessing vast amounts of customer data, have been slower to harness this potential due to legacy systems and organisational complexity. As fintech companies continue to refine their data-driven insights, they are effectively outpacing traditional banks in tailoring services to individual customer needs.

c. Lower Fees and Costs : One of the most attractive aspects of fintech solutions is the ability to provide cost-effective services. Traditional banks typically have higher overhead costs due to maintaining physical branches and extensive operational infrastructure. In contrast, fintech startups operate with leaner structures, allowing them to offer services at lower fees and competitive rates.

Fintech companies have introduced digital-only banking models that significantly reduce operational costs. This cost advantage enables them to offer higher interest rates on savings accounts, lower transaction fees, and reduced foreign exchange charges, thereby appealing to cost-conscious customers.

d. Access to Underserved Markets: Traditional banks have historically focused on serving customers in densely populated urban areas, leaving vast segments of the population underserved, particularly in rural and remote regions. With their agile and scalable digital platforms, Fintech companies have bridged this gap by reaching previously untapped markets.

Mobile banking apps and online platforms have become crucial tools for financial inclusion, allowing people in underserved areas to access banking services without needing physical branches. As fintech expands its reach, traditional banks face the challenge of retaining customers in a more competitive landscape.

e. Innovative Payment Solutions: Fintech has revolutionised the way people conduct transactions and manage their money. Mobile payment apps, peer-to-peer (P2P) transfers, and contactless payment solutions have become commonplace in fintech platforms. These innovations provide users greater convenience, security, and speed in handling their finances.

Traditional banks have started incorporating similar payment technologies in response to the fintech disruption. However, fintech’s early mover advantage and agile development cycles keep them ahead in this race for innovative payment solutions.

UX Challenges of AML & KYC Compliance

Amidst the growing fintech landscape, Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance cannot be overstated. These regulatory processes are essential for safeguarding against financial crimes, ensuring customer due diligence, and maintaining the financial system’s integrity.

However, incorporating robust AML and KYC procedures into fintech platforms poses unique UX challenges that designers must address to balance compliance and user experience.

a. Lengthy Onboarding Processes: AML and KYC compliance requires thorough identity verification, document submission, and risk assessment during onboarding. While these measures are vital for fraud prevention, they can significantly prolong the account registration process.

UX designers must find creative ways to streamline these procedures while complying with regulatory requirements. Implementing intelligent form validations, enabling document scanning and verification using mobile cameras, and breaking down the onboarding into smaller, digestible steps can enhance the user experience and reduce the friction associated with compliance procedures.

b. Data Security and Privacy Concerns: The collection and storage of sensitive personal information during AML and KYC processes raise legitimate privacy concerns among users. Fintech platforms must prioritize data security to protect sensitive customer data from potential breaches and unauthorized access.

UX designers must communicate the platform’s security measures and privacy policies in a language that users can easily understand. Utilizing secure encryption protocols, conducting regular security audits, and providing users with options to manage their data can foster a sense of trust and transparency.

c. Balancing Compliance Messages: AML and KYC compliance often require platforms to display mandatory messages, disclaimers, and warning notices to users. These messages can be overwhelming, leading to a cluttered and confusing user interface.

UX designers should strategically place compliance messages and use concise, user-friendly language to communicate requirements. Progressive disclosure techniques, where additional information is revealed only when necessary, can prevent overwhelming users with compliance-related content.

d. False Positives and Customer Disruptions: AML systems are designed to flag suspicious transactions and activities, leading to potential false positives. In such cases, legitimate user transactions may be halted or flagged for further review, causing inconvenience and frustration.

To mitigate this challenge, UX designers should design clear and user-friendly error messages that guide users on resolving flagged transactions efficiently. Additionally, implementing customer support features like live chat or 24/7 helplines can quickly assist users facing transaction disruptions.

e. Ongoing Monitoring and Updates: AML and KYC compliance is an ongoing process that requires regular updates and monitoring of user data. Periodic re-verification and updates can be cumbersome for users who expect seamless experiences.

UX designers can alleviate user frustration by implementing automated reminders and providing user-friendly interfaces for updating information. Employing AI-powered systems to intelligently prompt users for updates based on the relevance of their data can streamline the compliance maintenance process.